These topics were covered in my 04/01/2020 newsletter to Koch Capital's investment management and retirement planning clients. With the S&P 500 hovering around the 2900 range, the stock market is currently pricing in the best case recovery scenario. This outcome is difficult to fathom given all the virus unknowns and the inter-linked risks of starting up an economy in stasis (think of the cold power-up of the command module scene in the movie Apollo 13). However, the most likely outcome is and will always be a better day tomorrow.

_____________________________

What the Stock Market IsTelling Us

Quite a first quarter! I’m going to jump straight into the financial implementations of this coronavirus-induced market sell-off, ignoring the health and lifestyle issues as I’m sure you are already receiving a fire hose of infection data and what-it-all-means commentary.

With yesterday’s stock market close (4/1/2020), the SPY ETF (our S&P 500 proxy for the overall stock market) settled around 2460, down 27% from the February high water mark of 3380. The annotated stock chart above shows the SPY price decline since hitting its February peak. I added the three red bands to provide an approximate range of possible future market outcomes based on the SPY daily close on any given day this month.

The stock market discounts forward to where it thinks the economy and corporate earnings will be nine months or so from today. If the market closes between 2600 and 2300, then it is forecasting a moderate recession with negative GDP growth in Q2 and Q3 and a return to positive growth in Q4. If the market closes….again, on any given day during April….above the 2600 level, the market sees a mild recession with a V-shape rapid recovery. Nobody knows how this sell-off will play out. As the market consumes the latest coronavirus data, it will adjust its forward economic outlook by raising or lowering that day’s SPY closing price.

While many market pundits as well as myself believe that the most likely outcome of the coronavirus pandemic is a mild-to-moderate recession through 2020, nobody can know for sure how this recession will play out. If the stock market (SPY) re-tests the previous low range below 2300….and stays there throughout April….then the market is predicting a severe recession lasting 2-5 years (my estimate) or even the possibility of a depression lasting longer.

No doubt the next two weeks will be scary given the peak negative news cycle. The market may retest the 2300 level, a peak-to-trough decline of more than 32%. The key is whether the market stays below the 2300 level for next six weeks. That would signal, in my opinion, an expected economic contraction more serious and long lasting than just a mild or moderate recession. But markets can be wrong too.

Shallow Risk vs. Deep Risk

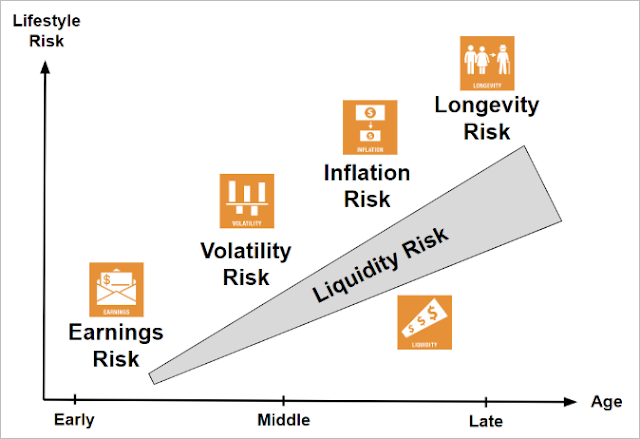

With Koch Capital’s Retirement Planning clients, we spend considerable planning time and energy addressing the five primary risk categories listed below. For a good overview of these risk types, please see my risk overview video. The coronavirus pandemic primarily impacts investment risk, a type of volatility risk, which affects households that have substantial savings invested in the stock market.

All risk types have both a magnitude and a duration component, which characterize whether a given risk danger is shallow or deep. For example, market sell-offs favor shallow volatility risk since the typical price decline is less than 20% and generally recovers within a year. Beginning in early 2000, the NASDAQ tech-heavy index fell over 70% through 2002 and then took 15 years to recover. That’s deep volatility risk.

While market sell-offs hurt all investors, the 2000-2002 correction impacted (think permanent reduction in living standard) disproportionately those who foolishly invested in just the hot tech stocks of the day. Deep volatility risk can be mitigated through global asset class diversification. But to eliminate this risk, you have to either diversify substantially beyond stocks into less volatile assets like cash and cash equivalents, social security (delaying), government bond ladders, guaranteed annuities, physical gold, private pensions, etc., or have enough risk capacity (high funded ratio) to ride out a prolonged market downturn.

The coronavirus pandemic is exposing households to other potential deep risk types. If your job goes away and you cannot re-tool into another profession that generates an equivalent wage, that’s potentially deep earnings risk. If your cash cushion is drawn down and you have to execute an emergency IRA withdrawal, that’s potentially deep liquidity risk. If the flood of relief dollars to coronavirus victims leads to a new generational cycle of persistent high inflation, that’s deep inflation risk. While I’m not predicting any of these scenarios, they are all contingencies we should consider and plan for.

While most shallow risk dangers are transient and self correcting, deep risk events trigger whole system failures, like a permanent funding shortfall of your desired retirement lifestyle. One deep risk type failure can cascade into another and then another, resulting in permanent loss of financial resources. This linkage between risk types is called dependent risk, and it’s always deep and unpredictable. For more on risk types if interested, please see William Bernstein’s brilliant booklet on the subject.

What We Can Control

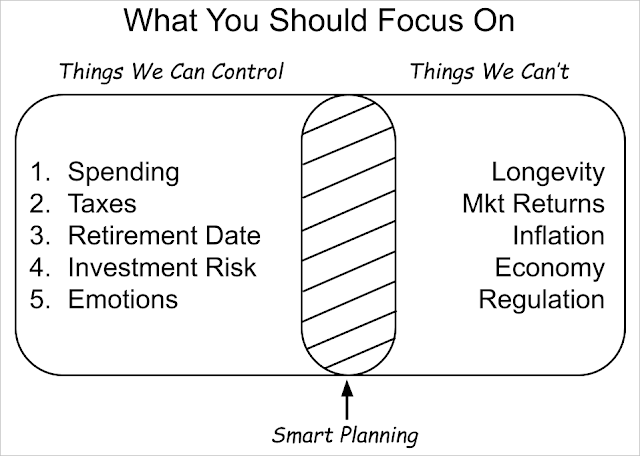

The loss of control in your personal life takes a huge emotional toll. The diagram below reminds us that we still control certain financial aspects of our lives. I can help you on the emotional side with trading decisions, budgeting your cash reserves and minimizing investment taxes. On your end, please consider revisiting your current budget assumptions, desired retirement date, if not already retired, and your ideal investment risk preference.

We’ll get through this crisis household by household and as a nation. Post-coronavirus I’m ready to re-assess your investment risk preference if this market sell-off is feeling a tad too scary. My best advice right now is to stay the course and ride out the wild stock price swings. The best stock market gains of the year usually follow immediately after the worst losses.

Please stay safe, positive, and thank a healthcare worker. All the best...Jim

Quite a first quarter! I’m going to jump straight into the financial implementations of this coronavirus-induced market sell-off, ignoring the health and lifestyle issues as I’m sure you are already receiving a fire hose of infection data and what-it-all-means commentary.

Source: Stockcharts.com with Koch Capital annotation

With yesterday’s stock market close (4/1/2020), the SPY ETF (our S&P 500 proxy for the overall stock market) settled around 2460, down 27% from the February high water mark of 3380. The annotated stock chart above shows the SPY price decline since hitting its February peak. I added the three red bands to provide an approximate range of possible future market outcomes based on the SPY daily close on any given day this month.

The stock market discounts forward to where it thinks the economy and corporate earnings will be nine months or so from today. If the market closes between 2600 and 2300, then it is forecasting a moderate recession with negative GDP growth in Q2 and Q3 and a return to positive growth in Q4. If the market closes….again, on any given day during April….above the 2600 level, the market sees a mild recession with a V-shape rapid recovery. Nobody knows how this sell-off will play out. As the market consumes the latest coronavirus data, it will adjust its forward economic outlook by raising or lowering that day’s SPY closing price.

While many market pundits as well as myself believe that the most likely outcome of the coronavirus pandemic is a mild-to-moderate recession through 2020, nobody can know for sure how this recession will play out. If the stock market (SPY) re-tests the previous low range below 2300….and stays there throughout April….then the market is predicting a severe recession lasting 2-5 years (my estimate) or even the possibility of a depression lasting longer.

No doubt the next two weeks will be scary given the peak negative news cycle. The market may retest the 2300 level, a peak-to-trough decline of more than 32%. The key is whether the market stays below the 2300 level for next six weeks. That would signal, in my opinion, an expected economic contraction more serious and long lasting than just a mild or moderate recession. But markets can be wrong too.

Shallow Risk vs. Deep Risk

With Koch Capital’s Retirement Planning clients, we spend considerable planning time and energy addressing the five primary risk categories listed below. For a good overview of these risk types, please see my risk overview video. The coronavirus pandemic primarily impacts investment risk, a type of volatility risk, which affects households that have substantial savings invested in the stock market.

Source: The InformedHousehold.com®

All risk types have both a magnitude and a duration component, which characterize whether a given risk danger is shallow or deep. For example, market sell-offs favor shallow volatility risk since the typical price decline is less than 20% and generally recovers within a year. Beginning in early 2000, the NASDAQ tech-heavy index fell over 70% through 2002 and then took 15 years to recover. That’s deep volatility risk.

While market sell-offs hurt all investors, the 2000-2002 correction impacted (think permanent reduction in living standard) disproportionately those who foolishly invested in just the hot tech stocks of the day. Deep volatility risk can be mitigated through global asset class diversification. But to eliminate this risk, you have to either diversify substantially beyond stocks into less volatile assets like cash and cash equivalents, social security (delaying), government bond ladders, guaranteed annuities, physical gold, private pensions, etc., or have enough risk capacity (high funded ratio) to ride out a prolonged market downturn.

The coronavirus pandemic is exposing households to other potential deep risk types. If your job goes away and you cannot re-tool into another profession that generates an equivalent wage, that’s potentially deep earnings risk. If your cash cushion is drawn down and you have to execute an emergency IRA withdrawal, that’s potentially deep liquidity risk. If the flood of relief dollars to coronavirus victims leads to a new generational cycle of persistent high inflation, that’s deep inflation risk. While I’m not predicting any of these scenarios, they are all contingencies we should consider and plan for.

While most shallow risk dangers are transient and self correcting, deep risk events trigger whole system failures, like a permanent funding shortfall of your desired retirement lifestyle. One deep risk type failure can cascade into another and then another, resulting in permanent loss of financial resources. This linkage between risk types is called dependent risk, and it’s always deep and unpredictable. For more on risk types if interested, please see William Bernstein’s brilliant booklet on the subject.

What We Can Control

The loss of control in your personal life takes a huge emotional toll. The diagram below reminds us that we still control certain financial aspects of our lives. I can help you on the emotional side with trading decisions, budgeting your cash reserves and minimizing investment taxes. On your end, please consider revisiting your current budget assumptions, desired retirement date, if not already retired, and your ideal investment risk preference.

Source: Koch Capital

We’ll get through this crisis household by household and as a nation. Post-coronavirus I’m ready to re-assess your investment risk preference if this market sell-off is feeling a tad too scary. My best advice right now is to stay the course and ride out the wild stock price swings. The best stock market gains of the year usually follow immediately after the worst losses.

Please stay safe, positive, and thank a healthcare worker. All the best...Jim

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and Founder and Principal of the Informed Household financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clientsGeneral Disclosures

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Past performance is no guarantee of future results.

Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision.Under no circumstances does the information contained within represent a recommendation to buy or sell any particular security or pursue any investment strategy. There is a risk of loss from an investment in securities. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. Please refer to the Site Disclosure page for additional information.

Third Party Information

While Koch Capital and the Informed Household have used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live 'links' to other Internet addresses can be accessed. Neither Koch Capital nor the Informed Household endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.